Recently, the domestic NPI market showed a game between supply and demand sides, with prices fluctuating downward. Upstream cost support gradually strengthened, keeping quotations stable, while downstream demand side exhibited strong wait-and-see sentiment with a lack of mainstream transaction guidance. SMM analyzes as follows based on current market prices, inventory, supply-demand, and costs:

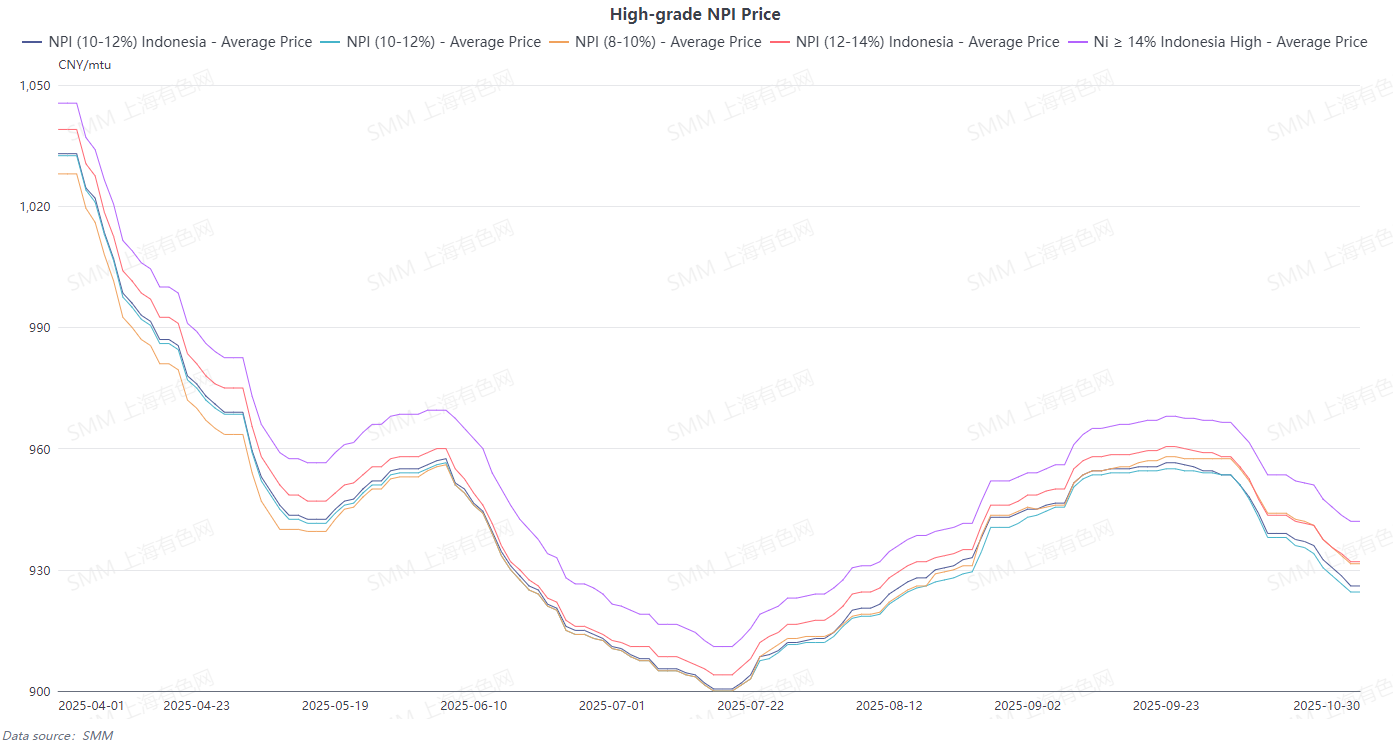

Price-wise, transaction-wise, recent prices for 10-12% material (port, self pick-up) were around 920-925 Yuan/nickel unit, and for 12-14% material (port, self pick-up) around 930-935Yuan/nickel unit. Quotation-wise, as prices continued to decline recently, domestic material transactions were mainly based on long-term contracts, with most upstream players suspending external quotations. Transactions for 8-10% material were hard to find, and most traders also adopted a wait-and-see approach. Downstream enterprises maintained just-in-time procurement amid the declining trend and also held a wait-and-see attitude.

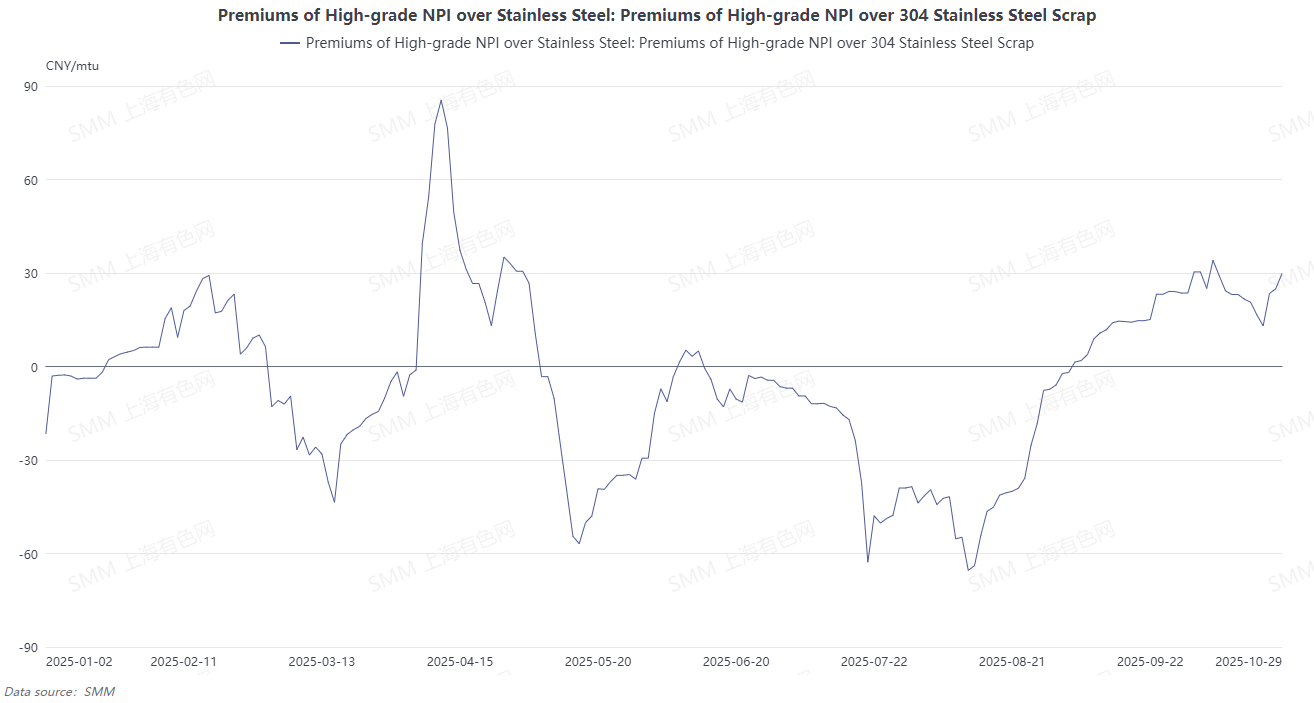

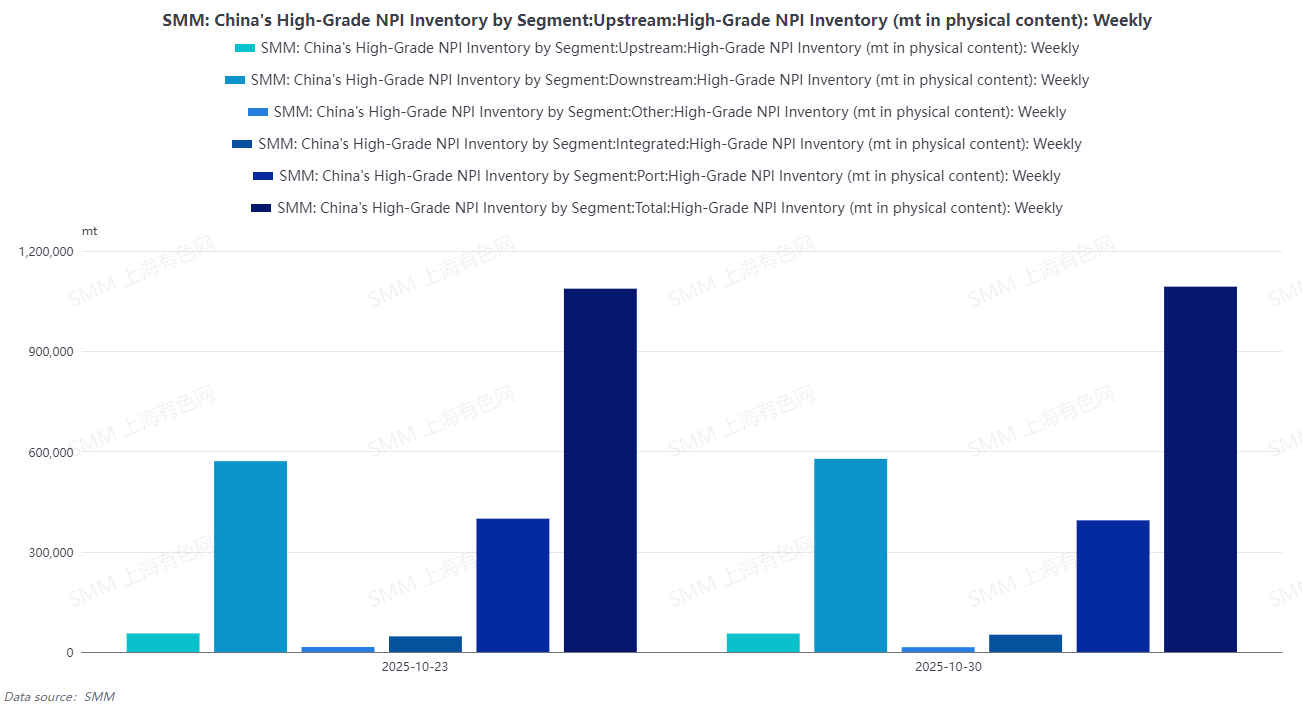

Demand side, as the traditional off-season approaches, several stainless steel enterprises successively implemented production cuts. Meanwhile, high-grade NPI maintained a premium over stainless steel scrap within the month, leading downstream enterprises to increase the proportion of stainless steel scrap used as raw material, reducing total demand for high-grade NPI. According to SMM statistics, this week, days of inventories for high-grade NPI at the downstream stage were 14.04 days, and at the port stage were 10.03 days, indicating relatively sufficient market supply. Most downstream enterprises only maintained just-in-time procurement.

Supply side, Indonesia's high-grade NPI production in October is expected to continue increasing slightly, while domestic high-grade NPI production also increased MoM driven by production resumptions at enterprises, leading to an increase in total high-grade NPI supply.

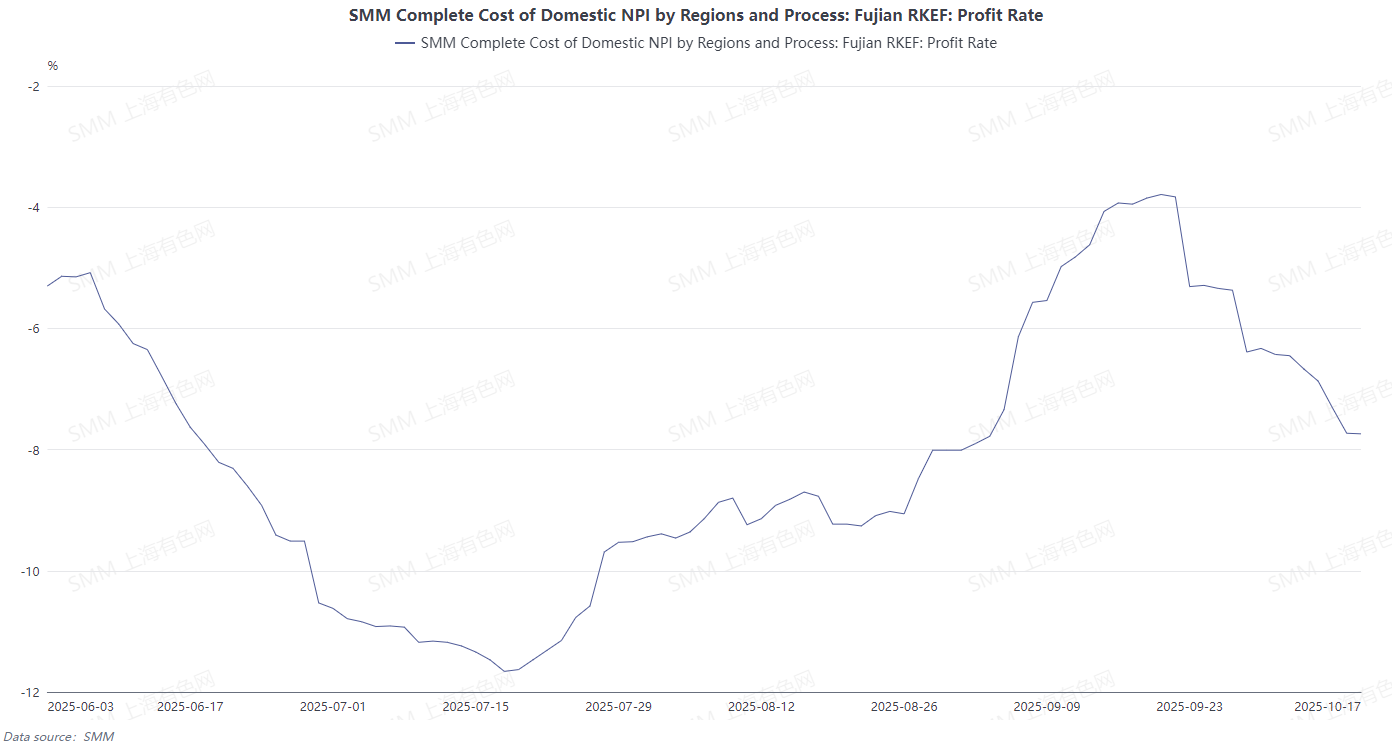

Cost side, as nickel ore and auxiliary material prices rose and high-grade NPI prices fell, losses at domestic smelters widened, and profits at Indonesian high-grade NPI smelters also decreased MoM. Current high-grade NPI quotations have reached the cost line of some Indonesian smelters, making upstream enterprises less accepting of low prices. Current low-price transactions in the market are mostly deals between traders, who are destocking, and downstream players. Therefore, with cost support gradually strengthening, upstream quotations for high-grade NPI are stabilizing.

Overall, the high-grade NPI market is experiencing an increase in supply, a decrease in demand, and ample inventory, indicating a short-term supply surplus. In terms of economic substitution, for downstream users, the cost per mtu of stainless steel scrap is about 20 Yuan/nickel unit lower than that of high-grade NPI. On the cost side for downstream sectors, stainless steel enterprises are facing losses, leading to a lower acceptance ceiling for high-grade NPI prices. Therefore, although the decline in high-grade NPI prices has slowed down under current cost support, given the weakening fundamentals and the significant economic substitutability of stainless steel scrap, high-grade NPI prices are still expected to have further downside room.It is expected that high-grade NPI prices will remain in the doldrums in Q4 2025, but will stabilize and rebound in the long term with cost support.